Employment opportunitiesįor information about the employment opportunities currently available in New Jersey, please visit the Careers section of our site.

Through the firm’s Birdies Fore Love program as a part of the 2017 RSM Classic, RSM raised over $80,000 for The Valerie Fund in Maplewood, New Jersey in 20 and more than $60,000 for Children’s Specialized Hospital (CSH) in New Brunswick, New Jersey in 2015. Our personnel devote their time, money and efforts to many local charitable organizations, fundraisers and events. Our commitment to New Jersey extends beyond serving the needs of our clients.

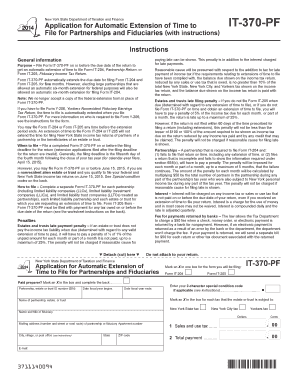

2016 tax extension ny series#

This investment in a state-of-the-art location with enhanced amenities and meeting space is the latest in a series of steps RSM has taken to demonstrate its continued commitment to serving the New Jersey metro area. New Jersey’s centralized location, diverse range of industries and highly skilled workforce make it one of the best business locations in the United States.

2016 tax extension ny professional#

We’re proud to offer exceptional professional growth opportunities for our people and are honored to have been named one of the Best Places to Work in New Jersey for the second year in a row! By growing our physical presence in the community, RSM is in an even better position to offer its robust audit, tax and consulting services to existing clients and to welcome new ones. To accommodate our rapidly growing practice, RSM New Jersey expanded its footprint in Metropark during the summer of 2018. Overall, the Empire State has the highest tax burden in the nation.RSM has a history of diligently serving companies in the Garden State. New York and Oregon “have the highest individual income tax as a fraction of personal income, 4.76 percent and 4.04 percent, respectively.” New Jersey has the “highest property tax as a fraction of personal income,” the survey says. However, as a general rule, taxpayers should file on time and avoid compounding an already high tax bill: Taxes in the New York/New Jersey area are the highest in the nation, according to a new WalletHub survey. Kiely says delay is acceptable if a taxpayer is in the middle of forming a partnership and isn’t sure about its income. “The most common reason for filing an extension is you haven’t received or assembled all the information you need to file a complete and accurate return by the initial due date,” Morris adds. Still, there are some reasons to delay, tax pros say. 1, 2016, to file, the statute runs until Oct. “By filing an extension, the statute starts running from the date you actually file the return, so if you wait until Oct. “So if you file your 2015 tax return by the initial due date, the statute of limitations runs three years from April 18, 2016, or to April 18, 2019,” Morris notes. Delaying could hurt you years from now.Įxtending by six months also delays by six months the statute of limitations taking effect, which can protect the taxpayer down the road. Kiely notes that the total interest rate along with penalty on filing late was recently 5 percent.Īnd that may not be the end of it, says Kenny Morris, a Las Vegas CPA with clients on Long Island. “You can get a six-month extension on filing, but you can’t get an extension in paying taxes,” says Bernard Kiely, a New Jersey CPA. Requests for extensions can be filed online through the Internal Revenue Service’s Web site or by mail using Form 4868, but it must be postmarked no later than Monday. That’s because the tax ticker keeps running - and with interest, certified public accountants say. It’s easy to call off the IRS dogs on Monday and get an extension on filing your tax return, but it might not be a good idea. The Democrats are holding New York City backīlame New York pols for the city's high jobless rate Manchin privately proposes revisions to Build Back Better billīreak for gas: Most Americans want fed, state fuel taxes stopped, poll shows

0 kommentar(er)

0 kommentar(er)